Your Council Tax

Local government finances under pressure

Like all local authorities, Enfield Council is facing a financial storm of rising demand for our services and high inflation, while being underfunded by central government.

The cost-of-living crisis has meant more residents are turning to us for help, increasing pressure on council resources, while inflation has caused a threefold increase in our costs.

At the same time, a recent Institute of Fiscal Studies (IFS) report found that Enfield was the 7th most underfunded authority in the country - the gap between our need and government funding was £271 for every resident in our borough.

Enfield received the second-lowest amount of additional government funding in London from the recent finance settlement. While we continue to lobby for a fairer funding deal for Enfield, as a result of these pressures, the council is having to make savings of approximately £24m this year to make up for the funding shortfall. This will still not be enough to cover the gap in our funding.

Council Tax 2024-25

This financial context means that, along with most other councils, we have had to make the difficult choice to increase Council Tax for this year to protect the services you and the most vulnerable rely on.

The increase in Enfield’s share of the Council Tax for 2024/25 is 4.99%, which includes 2.00% for the adult social care precept. This increase equates to £1.45 per week or £7.58 per month (when paid over 10 instalments) for a Band D property.

The Mayor of London has also increased the GLA’s share of the Council Tax by 8.58%, which is £0.72 per week or £3.72 per month for a Band D property.

We estimate your Council Tax will increase by an average of £2.17 per week, for a Band D property, or £11.30 a month.

See our Council Tax pages for further information about Council Tax.

Helping Enfield residents struggling to pay their bills

We know this is a very difficult time for residents with living costs continuing to rise.

That is why we have set aside some funding in the form of hardship payments for residents in the most need and those impacted by the change to the Council Tax Support Scheme.

To find out what cost-of-living support is available, see our Cost of living support pages. To find out about other support and benefits you may be entitled to, including Council Tax Support and Council Tax Support Hardship, see our Benefits pages.

If you’re an Enfield Council housing tenant struggling to pay your rent, our Rent Income Team can arrange a payment plan. Email rent.council.housing@enfield.gov.uk or ring 020 8379 1000 and select option 4.

The budget 2024-25

How the money will be spent

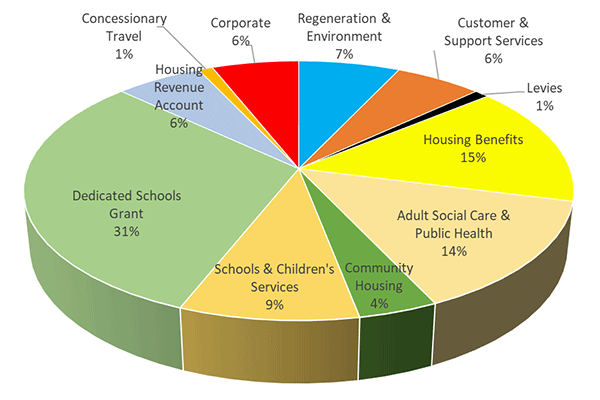

In the coming year the council will spend £1,351 million, of which £164.1 million comes from Council Tax and £120.7 million from business rates. The remaining amount comes from government grants, subsidies, fees and charges, and other income. This includes funding for schools and payment of housing benefits.

The final budget took into account the feedback from the budget consultation exercise, changes in government funding, local priorities, increases in demand for services and other increased costs.

How Enfield's budget will be spent in 2024-25

Council’s gross expenditure 2024-25

Your Council Tax also helps to pay for the Greater London Authority (GLA), which funds and runs the police, fire and transport services across London. Their costs are shown separately on your bill.

Calculating your Council Tax

We charge Council Tax on most homes. There is one bill for each home, whether it is a house, bungalow, flat, maisonette, mobile home or houseboat, and whether the people living in the home own it or rent it.

Each home has been put into a band according to its value on the open market on 1 April 1991. The Council Tax Base for 2024/25 has been set at 102,954 band ‘D’ equivalent homes. Band D is the standard band for calculation of the Council Tax. The Council Tax for the other bands is calculated by following the rules laid down in the ‘Local Government Finance Act 1992’.

Your Council Tax bill will say which band your home is in. These costs assume two adults living in a property.

If you are entitled to Council Tax support, your bill will be reduced by a discount as shown on your bill.

| Council Tax valuation band | Proportion in relation to band D | Amount of tax for Enfield 2024/25 | Amount of tax for GLA 2024/25 | Total Council Tax 2024/25 |

|---|---|---|---|---|

| A | 6/9 | £1,062.72 | £314.27 | £1,376.99 |

| B | 7/9 | £1,239.84 | £366.64 | £1,606.48 |

| C | 8/9 | £1,416.96 | £419.02 | £1,835.98 |

| D | 9/9 | £1,594.08 | £471.40 | £2,065.48 |

| E | 11/9 | £1,948.32 | £576.16 | £2,524.48 |

| F | 13/9 | £2,302.56 | £680.91 | £2,983.47 |

| G | 15/9 | £2,656.80 | £785.67 | £3,442.47 |

| H | 18/9 | £3,188.16 | £942.80 | £4,130.96 |

Why has my Council Tax bill changed?

| For an average band D property | Cost per month |

|---|---|

| Core Council Tax to protect vital services - increased by 2.99% in 2024/25 | +£4.54 per month over 10 monthly payments |

| Increase of 2% in precept to help pay for adult social care costs | +£3.04 per month over 10 monthly payments |

| 8.58% increase in Greater London Authority costs | +£3.72 per month over 10 monthly payments |

As a result, an average Band D property will see an increase in the Council Tax charge of 5.79% or £11.30 per month over 10 monthly payments.

Supporting financial information 2024-25

Enfield Council's expenditure and income, external levies and the Council Tax requirement

| Statutory levies | 2023/24 £million | 2024/25 £million |

|---|---|---|

| Lee Valley Regional Park Authority | 0.25 | 0.27 |

| North London Waste Authority: Household Waste Levy | 8.80 | 12.16 |

| Environment Agency | 0.23 | 0.25 |

| London Pension Fund Authority | 0.32 | 0.32 |

| Gross expenditure | 1,292.41 | 1,351.34 |

| Gross income | (1,145.45) | (1,187.22) |

| Council Tax requirement | 146.96 | 164.12 |

| Enfield Council's gross expenditure (excluding levies) | 1,282.81 | 1,338.34 |

| £million | |

|---|---|

| Council Tax requirement 2023/24 | 147.0 |

| Additional costs including population growth | 48.6 |

| Changes from previous year's government funding | (16.2) |

| Budget savings and increases in income | (15.3) |

| Council Tax requirement 2024/25 | 164.1 |

Greater London Authority

Introduction

The Mayor of London’s budget for the 2024-25 financial year sets out his priorities, including supporting Londoners through the current cost-of-living crisis. The budget also supports job creation and London’s business community, our city’s future growth and economic success and the Mayor’s work to continue building a safer, fairer and greener London for everyone.

This year’s budget will provide resources to improve the key public services Londoners need and help address the cost-of-living crisis. This includes extending the Mayor’s universal free school meals programme for all state primary school children for a further academic year until at least July 2025, freezing TfL pay as you go and other non-government regulated fares for the next twelve months and delivering more genuinely affordable homes. The budget also provides resources to support jobs and growth, fund skills and retraining programmes, help rough sleepers off the streets, invest in services for children and young people and make London a fairer and greener place to live. Moreover, it prioritises resources for the Metropolitan Police Service (MPS) and London Fire Brigade (LFB) to keep Londoners safe, including violence reduction initiatives, support for victims of crime, funding to maintain frontline officer numbers, continued reform of the MPS and the delivery of projects to divert vulnerable young people away from gangs and violence.

In light of the conditions imposed as a result of government funding deals, it has been necessary to provide additional resources through local taxation income, including Council Tax, to maintain London’s transport system and preserve and expand the bus network.

Council Tax for GLA services

The GLA’s share of the Council Tax for a typical Band D property has been increased by £37.26 (or 72 pence per week) to £471.40. The additional income from this increase in Council Tax will fund the Metropolitan Police and the London Fire Brigade, and will also go towards ensuring existing public transport services in London can be maintained, meeting requirements set by the government in funding agreements. Council taxpayers in the City of London, which has its own police force, will pay £166.27.

| Band D Council Tax (£) | 2023-24 | Change | 2024-25 |

|---|---|---|---|

| MOPAC (Metropolitan Police) | 292.13 | 13.00 | 305.13 |

| LFC (London Fire Brigade) | 62.48 | 4.26 | 66.74 |

| GLA | 22.44 | 0.00 | 22.44 |

| Transport Services | 57.09 | 20.00 | 77.09 |

| Total | 434.14 | 37.26 | 471.40 |

Controlling costs at City Hall and delivering the Mayor’s key priorities

The Mayor’s 2024-25 budget includes just under £500 million of savings and efficiencies, including from the more efficient use of office accommodation and technology and sharing back office and support functions across the GLA Group family. These savings have allowed the release of resources to help meet the Mayor’s key priorities.

The Mayor has already taken steps to improve air quality in London by introducing the Ultra Low Emission Zone (ULEZ) in central London in April 2019, which was expanded to the North and South Circular roads in Autumn 2021 and London-wide from August 2023. The Mayor has created a £210m scrappage scheme providing financial assistance to help eligible Londoners scrap or retrofit the highest polluting vehicles. He has continued to roll out his Green New Deal for London to address the climate emergency, with the objective of helping to create jobs and to double the size of the capital’s green economy by 2030. He will also invest over £350 million in 2024-25 through his Adult Education Budget to help tackle unemployment, support Londoners to secure better paid jobs and improve their household circumstances.

The Mayor will continue to ask the government to provide the maximum possible ongoing financial support to London businesses and Londoners to assist them through the current challenging economic situation, including the impact of rising food and fuel inflation, rents and mortgages. The Mayor has also responded to the cost-of-living crisis by providing £140 million of additional funding to extend his universal free school meals programme for London’s estimated 287,000 state primary school children, which commenced in September 2023, for the 2024-25 school year. This programme is expected to save London families up to £1,000 per child over two years.

The Mayor will also work with London’s business community, key investors and other stakeholders to grow our economy and ensure that London and Londoners’ interests are protected following the UK’s departure from the European Union. He will provide funding for new projects to bring communities together, tackle social inequality and support London’s businesses, including projects to help small and medium sized firms.

The Mayor’s Office for Policing and Crime (MOPAC)

The Mayor’s top priority is keeping Londoners safe and his Police and Crime Plan for 2022-25 sets out his vision for achieving this in partnership with the Metropolitan Police Service (MPS). The four key themes of the plan are:

- reducing and preventing violence including making London a city in which women and girls and young people are safer - and feel safer

- increasing trust and confidence in the MPS ensuring that it engages with Londoners and treats them fairly

- better supporting victims - improving the service and support that victims receive from the MPS and the criminal justice service

- protecting people from being exploited or harmed by reducing the number of young people and adults who are criminally exploited or harmed as well as keeping people safe online

The Mayor continues to spearhead efforts with the Metropolitan Police Commissioner to build an MPS that is trusted, representative of London and delivers the highest possible service to every community in our city through the New Met For London (NMfL) programme. An additional £189 million investment has been allocated to improve the MPS’s effectiveness and increase trust and confidence amongst Londoners in the police service.

The MPS is also facing sustained and ongoing financial pressures as it continues to deal with the challenges and associated costs of policing the nation’s capital. In response, the Mayor is investing an additional £151 million in 2024-25 in policing and crime prevention. This includes investing an extra £6.5 million in London’s Violence Reduction Unit so that more action can be taken to help divert young Londoners away from gangs and crime.

The Mayor is raising the police element of his Council Tax precept paid in the 32 London boroughs in 2024-25 by £13 for a typical Band D property, as assumed in government calculations of police spending power. In all, through his decisions in this and previous budgets, the Mayor has funded an additional 1,300 police officer posts and 500 extra Police Community Support Officers (PCSOs) from locally raised Council Tax and business rates revenues.

Transport for London

Transport for London (TfL) has faced significant financial challenges since the pandemic. The Mayor continues to work with the government to secure a sustainable long-term funding settlement for TfL to allow him to continue to invest in the transport network while making it more reliable and accessible. The Mayor’s priorities for TfL, subject to funding constraints where applicable, and key achievements include:

- Freezing TfL fares (excluding central government regulated fares such as travelcards) in 2024 with off peak fares being introduced on Fridays all day for an initial three month trial period between March and May 2024

- Working with London boroughs to maintain existing concessionary travel and assisted door to door transport schemes. This includes, for example, maintaining free bus and tram travel for under 18s as well as free off-peak travel across the network for older Londoners (supplemented by free travel for those aged 60+ before 9am on Fridays initially for three months from March to May 2024), the disabled, armed forces personnel in uniform and eligible armed services veterans and protecting the Taxicard and Dial-a-Ride schemes.

- Delivering the Elizabeth line on its full timetable and route. The Elizabeth line has increased central London’s rail capacity by 10% and is forecast to see upwards of 200 million passenger journeys per annum making it the busiest rail line in the UK. This follows on from the opening of the Northern line extension to Nine Elms and Battersea Power Station in September 2021.

- Rolling out new trains on the Piccadilly line, with the first new trains serving customers from 2025

- Enhancing capacity on the London Underground and rail services, and upgrading key stations such as Bank/Monument station, Old Street and Elephant and Castle as well as securing government funding to make Leyton and Colindale stations step-free

- Making public transport more accessible for everyone including making more tube and Overground stations step-free over the next 12 months. All 41 Elizabeth line stations are now step-free.

- Delivering the local regeneration and housing benefits arising from completing the extension of the London Overground on the Gospel Oak to Barking Line to serve Barking Riverside

- Expanding capacity and commencing rolling out new trains on the DLR network in 2024

- Maintaining the Bus and Tram one-hour Hopper fare and investing to sustain existing journey times and reliability on the bus network

- Providing additional funding for the rolling out of additional bus services including the Superloop network of 10 express bus routes which will improve connections and journey times between key outer London town centres and transport hubs

- Tackling the climate emergency including the expansion of the Ultra Low Emission Zone (ULEZ) London-wide to tackle air pollution in August 2023 supported by a £210 million vehicle scrappage scheme for small businesses and Londoners to help them switch to cleaner vehicles or retrofit their existing ones

- Investing in schemes designed to make walking, cycling and public transport safer, cleaner and more appealing in partnership with London boroughs

London Fire Commissioner

A new Community Risk Management Plan came into effect in January 2023 covering the period to 2029, replacing the previous London Safety Plan. The Mayor has provided resources to roll out a transformation programme to support the London Fire Brigade (LFB) in implementing the recommendations of the Grenfell Tower Inquiry and other key improvements.

In 2024-25 the London Fire Commissioner (LFC) will be investing in operational services to address the changing risks in London, including the introduction of new firefighting techniques and equipment as well as rolling out additional training to firefighters. There will also be a continued focus on improving the LFB’s culture, including the roll out of leadership training at all levels and continuing to embed a new set of values.

London Legacy Development Corporation

The London Legacy Development Corporation (LLDC) was set up to ensure that the city benefits from a long-term legacy from the London 2012 Olympic and Paralympic Games. The Mayor’s 2024-25 budget provides funding to complete the construction of East Bank, one of the world’s largest and most ambitious cultural and education districts, in Queen Elizabeth Olympic Park. It will bring an additional 1.5 million visitors to the park and surrounding area each year, and more than 2,500 jobs will be created, generating an estimated £1.5 billion for the local economy. The LLDC is not funded from Council Tax.

Old Oak and Park Royal Development Corporation

The Old Oak and Park Royal Development Corporation (OPDC) has been established to support the creation of 65,000 new jobs and at least 24,000 new homes in west London over the next 20 years. It will build on the regeneration benefits which High Speed 2 (HS2), the Elizabeth line and the Great Western Mainline stations at Old Oak Common are expected to bring locally. The Mayor’s 2024-25 budget provides additional resources to enable the corporation to continue the delivery of its programme. The OPDC is not funded from Council Tax.

Summary of GLA Group budget

The tables below show where the GLA’s funding comes from and the reasons for the year on year change in the budget. It also explains how the GLA has calculated the sum to be collected from Council Tax (the Council Tax requirement).

| How the GLA’s budget is funded (£ million) | 2024-25 |

|---|---|

| Gross expenditure | 17,480.4 |

| Government grants and retained business rates | -7,433.2 |

| Fares, charges and other income | -8,130.3 |

| Change in reserves | -426.6 |

| Amount met by Council Tax payers (£m) | 1,490.3 |

| Changes in spending (£ million) | 2024-25 |

|---|---|

| 2023-24 Council Tax requirement | 1,353.1 |

| Net change in service expenditure and income | 485.3 |

| Change in use of reserves | 43.7 |

| Government grants and retained business rates | -272.3 |

| Other changes | -119.5 |

| Amount met by Council Tax payers (£m) | 1,490.3 |

Detailed budget by service area

The table below compares the GLA Group’s planned expenditure on policing, fire and other services (including transport) in 2024-25 with 2023-24. LLDC and OPDC are not funded from Council Tax.

The GLA’s planned gross expenditure is higher this year. This reflects the additional resources the Mayor is investing in policing, the fire brigade and transport services. Overall the Council Tax requirement has increased because of the extra resources for the MPS and the LFB and to secure funding to maintain existing transport services including buses and the tube network.

There has been a 1.4% increase in London’s residential property taxbase.

To find out more about our budget, visit London.gov.uk.

| Summary of spending and income (£ million) (figures may not sum exactly due to rounding) | 2023-24 | 2024-25 |

|---|---|---|

| Gross expenditure | 4,533.1 | 4,797.2 |

| Government grants and business rates | -3,100.5 | -3,274.3 |

| Other income (including fares and charges) | -329.4 | -403.6 |

| Net expenditure | 1,103.2 | 1,119.2 |

| Change to level of reserves | -193.6 | -155.6 |

| Council Tax requirement (income) | 909.6 | 963.7 |

| Summary of spending and income (£ million) (figures may not sum exactly due to rounding) | 2023-24 | 2024-25 |

|---|---|---|

| Gross expenditure | 534.5 | 579.2 |

| Government grants and business rates | -284.6 | -293.8 |

| Other income (including fares and charges) | -48.1 | -54.5 |

| Net expenditure | 201.8 | 230.9 |

| Change to level of reserves | -6.7 | -19.5 |

| Council Tax requirement (income) | 195.1 | 211.4 |

| Summary of spending and income (£ million) (figures may not sum exactly due to rounding) | 2023-24 | 2024-25 |

|---|---|---|

| Gross expenditure | 11,165.0 | 12,104.1 |

| Government grants and business rates | -3,616.8 | -3,865.1 |

| Other income (including fares and charges) | -7,149.7 | -7,672.2 |

| Net expenditure | 398.5 | 566.8 |

| Change to level of reserves | -150.1 | -251.6 |

| Council Tax requirement (income) | 248.4 | 315.2 |

| Summary of spending and income (£ million) (figures may not sum exactly due to rounding) | 2023-24 | 2024-25 |

|---|---|---|

| Gross expenditure | 16,232.6 | 17,480.4 |

| Government grants and business rates | -7,001.9 | -7,433.2 |

| Other income (including fares and charges) | -7,527.2 | -8,130.3 |

| Net expenditure | 1,703.5 | 1,916.9 |

| Change to level of reserves | -350.4 | -426.6 |

| Council Tax requirement (income) | 1,353.1 | 1,490.3 |